Posts

Scams and fraud

/in Money Management/by Ralph StevensScams & Fraud

According to the Metropolitan Police, scams cost the British public Billions (yes – that’s Billions) of pounds every year. They come door-to-door, by mail, phone and online and they get more sophisticated every day and are a widespread problem. A Which? Survey in 2015 found that 54% of respondents had either personally been exposed to a scam, or had a friend or relative who had been, within the last 2 years. How can we protect ourselves from this onslaught?

There is a wealth of information online about how to recognise scams and fraud, and give details about the wide range that have been identified. The Little Book of Big Scams (little_book_scam) and the Scam Guide are two excellent resources.

It is unfortunately true that we all have to put time, effort and resources into keeping ourselves safe from

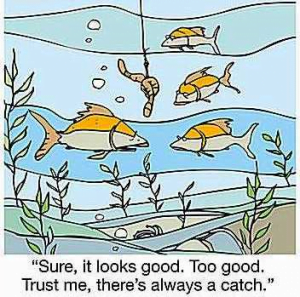

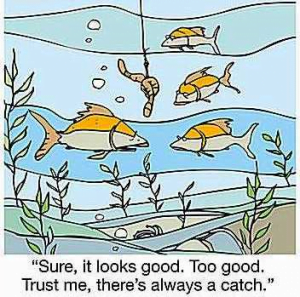

- “If it sounds too good to be true, it probably is!”

- Do not respond to “cold callers”.

Think: did you do anything to initiate the contact? If not, then do not reply. We do not like to be rude to somebody at the door or on the phone. You don’t have to be rude; just say “No thank you” and shut the door or put the phone down. Don’t fall for the “I’m not selling anything, I am just doing a survey for …..”. If it arrives in the mail, just put the letter or flyer in the bin.

Online scams and fraud are increasing rapidly. Suspect emails may be routed to your Spam or Trash folders by your ISP. Delete them without even opening them unless you are very sure that you recognise the sender (some emails do get directed incorrectly by the ISP but be careful if you accept them). Phishing emails, that appear authentic and to originate from authoritative sources such as your bank, are becoming more prevalent. It is very likely that you will have received emails from supposed banks with which you do not even have an account. They should be easy to spot! Your bank or companies like Amazon will never ask you for sensitive information to be sent to them by email. Never respond to such emails or click on links they contain, even if you think they might genuine. If you want to check, get their phone number from your account statement and call them. And, whatever you do, never, ever click on a link in an email. It might appear that it will take you to your bank web site but it is easy to set it up to take you elsewhere.

You can avoid some unwanted phone calls by registering with the Telephone Preference Service. Unfortunately, this does not prevent all unwanted calls and scammers are least likely to abide by their rules. For a small cost, you can purchase a call blocking device that attaches to your phone and allows you to receive only calls you want to accept. BT also has a range of phones with the built-in capability of call blocking.

Using this site

Follow us on Facebook

Follow us on Twitter (X)

Related Links

Below are some links to other sites you may find useful.

Scaling Pages

To Zoom In

Hold down [Ctrl] and tap [+]

To Zoom Out

Hold down [Ctrl] and tap [-]